- It is suggested that investors should continue to pay attention to the high-quality target of Weichai Power

It has become a consensus from the government level to the people at the grass-roots level to optimize 20 epidemic prevention and control policies, and to optimize the new 10 epidemic prevention and control policies to minimize the impact of COVID-19 on the economy and life. It is expected that with the gradual implementation of the policy of optimizing epidemic prevention and control, the recovery of domestic macroeconomic activity has become a clear card, and some industries previously affected by the epidemic, such as infrastructure, logistics, are expected to usher in gradual repair, At the same time, due to the low economic base in 2022 and the low position of the heavy truck industry, the market also generally raised expectations for the growth of the above industries in 2023.

Taking Weichai Power, a leading enterprise in the domestic heavy truck industry, as an example, mainstream financial institutions such as HSBC, Dahe and Citigroup have recently upgraded their corporate ratings and target prices, suggesting that investors actively increase their holdings. From the actual feedback of the capital market, since October 24, Weichai Power Hong Kong Stock (02388. HK) has risen by 56% from a low point in more than a month, successfully outperforming the Hang Seng Index, showing a good recognition of the capital market.

In fact, as an important production tool, the heavy truck is the target that directly benefits from the improvement of economic activity. At the same time, the heavy truck industry cycle has been at the bottom of recovery. Under the double positive background of superimposed epidemic situation and industry cycle, it is not difficult to understand the enthusiasm of investors for Weichai Power's positive shareholding. The following plan is to further analyze the market prospects of Weichai Power from the perspectives of industry and company fundamentals.

Resonance expectation of epidemic policy optimization and industry cycle bottoming out

As mentioned earlier, logistics and infrastructure are one of the industries that have been significantly benefited from the optimization of epidemic policies. The flush logistics index and infrastructure engineering index have fully reflected this optimistic expectation.

Logically, the recovery trend of logistics and infrastructure is also very clear.

For logistics, the result of the optimization of epidemic policy is the recovery of normal life and production activities. The increase of economic activity will directly lead to the increase of demand for goods transportation. For example, if the factory can maintain normal production in a normal way, the demand for supply chain accessories will certainly be much greater than that when the production is stopped under control. At the same time, the optimization of epidemic policy will also help to enhance the optimistic expectation of business owners for future production, gradually increase the investment in production, which will objectively increase the demand for logistics turnover, Drive market demand for heavy trucks.

The recovery of infrastructure construction is also expected to be very obvious. The core is that infrastructure construction has become one of the key points for the country to promote economic recovery. The government departments continue to increase policy based financial instruments to promote the development of infrastructure construction.

In terms of the issuance of special bonds, in the first 11 months of 2022, the issuance of new special bonds nationwide exceeded 4 trillion yuan, a record high. In addition, many regions have begun to plan and reserve special debt projects for next year. Therefore, there is no shortage of funds in infrastructure construction. Previously, due to the impact of the epidemic, the physical workload of infrastructure construction was formed slowly, so the promotion effect on the industrial chain links such as heavy truck transportation was not obvious. With the acceleration of the formation of physical workload of infrastructure construction due to the optimization of epidemic policy, the transmission of funds to the industrial chain links such as heavy truck will be more smooth, stimulating the recovery of the heavy truck industry.

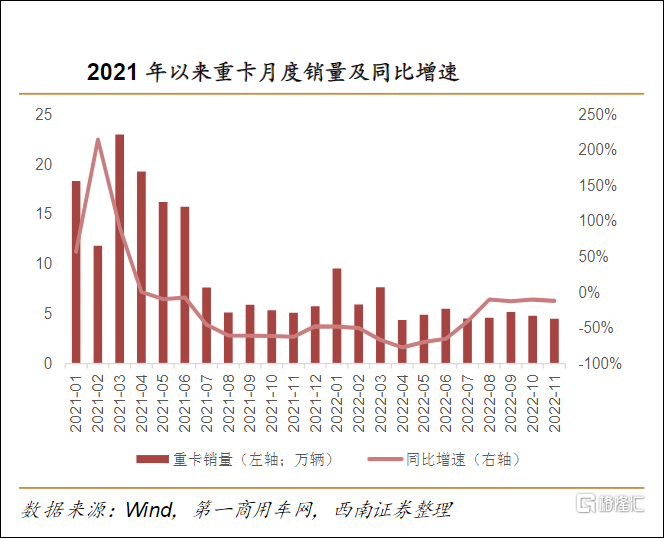

Back to the heavy truck industry cycle, the market generally believes that the heavy truck industry will usher in recovery in 2023. Southwest Securities pointed out that since last May, the heavy card market has suffered "19 consecutive drops", and the heavy card sales have fallen to the freezing point. However, since August, the year-on-year decline has narrowed to about 10%, showing a certain recovery in sales. The latest data in November showed that the sales volume of 45000 units, a year-on-year decrease of about 12%, was mainly affected by the epidemic situation in Guangzhou, Chongqing and other places.

In addition, from the perspective of renewal demand, the renewal cycle of heavy trucks in China is generally about seven years. Seven years after the low peak of heavy truck sales in 2015, 2022 happens to be the corresponding year. As a result, the demand for renewal is low this year, while the sales in 2016 and 2017 have increased significantly year on year. The corresponding seven years are 23 and 24 years, which means that the demand for renewal is expected to increase significantly from 23.

Therefore, in a comprehensive way, further optimization of epidemic policy will lead to the recovery of downstream demand such as logistics and infrastructure, and the upgrading of heavy trucks will bring new incremental demand. The recovery of heavy truck sales can be optimistic. At present, we should focus on the leading enterprises in the industry with certain performance.

Weichai Power took the lead in achieving performance recovery, highlighting its diversified layout advantages

According to the performance of Weichai Power in the third quarter, the net profit of the company's core business has achieved year-on-year and month on month quarterly growth.

This is mainly due to the successful diversified business layout of Weichai Power. Although the sales volume of the heavy truck industry has declined in the past two years, Weichai has continued to make efforts in the non road market, large bore high-end engines, agricultural equipment, intelligent logistics, new energy and intelligent networking and other fields to build the company's advantages in product quality, core performance and cost, and achieve common prosperity of diversified business portfolio by providing customers with cost-effective products, The diversified business structure has effectively improved the anti volatility of the company's performance.

For example, Weichai has always insisted on maintaining good investment in the core technology of heavy trucks, enabling the company's products to show outstanding competitiveness in the market, helping Weichai's products to continuously improve their market share, especially in the industry's low ebb, Weichai's technical advantages are becoming increasingly obvious.

On November 20, Weichai released the world's first commercial diesel engine with a body thermal efficiency of 52.28%. On the basis of the diesel engine body thermal efficiency breaking 50.23% in 2020 and 51.09% in January this year, Weichai once again set a new global record. GF Securities pointed out that Weichai has made many technical breakthroughs in the core engine component, which not only reflects the first-class technical level, but also contributes positively to the improvement of the technical level and market competitiveness of the company's entire vehicle. Data shows that in the third quarter of this year, Weichai Power's heavy truck engine installation rate exceeded 35%, a further increase of 6 percentage points over the same period last year. Among them, Weichai's high-end heavy truck engine products with more than 500 horsepower have achieved more significant improvement in market share. According to the company's announcement, the company's share in this market doubled from January to October this year.

Strong technical and product advantages are also reflected in Weichai's export business. In the first three quarters, the export sales of engines increased by more than 40% year on year, and the export sales of heavy trucks increased by 77% year on year; In the third quarter, the export sales of engines and heavy trucks increased by 60% and 125% year on year respectively. Obviously, the contribution of export business to the company's sales growth is gradually expanding, as is the case with high-end engine products with large cylinder diameters. The overseas sales of the company's high-end engines with large cylinder diameters accounted for about 47% in the first three quarters; In the third quarter, the overseas sales of large bore high-end engines accounted for about 50%. The good performance of large bore engines in overseas markets has also verified Weichai's technology and product strength once again, and high-end products can be unanimously recognized by customers at home and abroad.

In the field of agricultural equipment, which belongs to new business, according to relevant public information, the net profit in the first three quarters has exceeded 800 million yuan, exceeding the net profit of the whole year last year, demonstrating the good business performance of Weichai in the field of agricultural equipment. It is reported that at the end of October, Weichai Lovol Smart Agriculture will cooperate with Beidahuang Agricultural Reclamation Group to further increase high-power tractors, large feeding harvesters and other high-end smart agricultural equipment, so we can maintain optimistic expectations for the continued growth of Weichai's agricultural equipment business.

Focusing on Weichai's intelligent logistics business, under the influence of the order cycle and the supply chain pressure brought by the high inflation in Europe and the United States, Kaiao Group suffered a loss of nearly 100 million euros in the third quarter of this year, but the author believes that the loss is only a stage result, and the signal of Weichai's intelligent logistics performance has been shown.

First, under the influence of continuous and intensive interest rate hikes by the Federal Reserve, the central banks of major overseas countries have been driven into a round of rapid interest rate hikes. At present, the Federal Reserve's interest rate hikes are nearing the end, and the effect of interest rate hikes on inflation has been preliminarily signaled. According to the analysis of market institutions, the core CPI of the United States is expected to fall back to 3% and the CPI will fall back to 2.8% by the end of 2023. Therefore, it is expected that the pressure on the overseas supply chain will be relieved after the overseas CPI enters the decline channel, Lihao Kaiao Group's performance has improved.

Secondly, CAO Group is currently increasing its efforts to reduce costs and optimize project management processes, and is committed to building and strengthening the network of spare parts suppliers, and implementing the agile price adjustment strategy, in order to improve the risk resistance of CAO Group's operation and improve the profit level through the reform of internal management.

Take the price adjustment strategy as an example, which includes adding price adjustment clauses to all project contracts, optimizing how to formulate quotations, further improving the initial solution design of the project, and paying more attention to the risk management of the entire product portfolio. The author believes that this strategy is very targeted and necessary for optimizing the profit level of CAO Group, especially in the highly volatile global macroeconomic environment. The reason is that, compared with general fixed price contracts, due to the mismatch between the time of order signing and performance, the actual cost of performance may not really reflect the estimated price at the time of signing the order, which further aggravates the gap in the case of high inflation. After adopting the price adjustment strategy, KAIO Group can better solve this contradiction.

Therefore, based on the above two points, the author believes that Weichai's intelligent logistics performance faces greater resilience. Southwest Securities also said that the short-term performance pressure of CAO Group does not affect the long-term value growth of Weichai's intelligent logistics business, and the overall supply chain solution of CAO+Dematic is expected to help Weichai's intelligent logistics business continue to grow.

Superposing the optimistic expectation of the overall demand recovery of the heavy truck industry, the valuation center of the heavy truck industry is expected to move up. The author believes that Weichai's technical advantages in the field of heavy trucks may be able to successfully realize greater business value, and the diversified business layout will also help the company form a variety of income generating channels, making Weichai's performance growth more deterministic and growth potential, thus realizing the trend of double growth of valuation and performance. Under the background that big banks have upgraded their investment ratings one after another and the stock price has risen in volume and price, it is suggested that investors should continue to pay attention to the high-quality target of Weichai Power.

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~