- The lockdown in China, the world's second-largest economy and largest maker of solar modules has severely disrupted global supply chains

- The world has seen the risks of straining supply chains that have driven up the prices of clean energy technologies in recent years, making it more difficult for countries to transition to clean energy.

According to the International Energy Agency, if countries around the world fully meet their energy and climate commitments, the global market for key mass-produced clean energy technologies could be worth about $650 billion a year by 2030, more than three times its current level.

In its Energy Technology Outlook 2023 report, the agency said that related clean energy manufacturing jobs would more than double from the current 6 million to 14 million by the end of the decade. We're talking about a market for new clean energy technologies worth hundreds of billions of dollars and millions of new jobs, said Fatih Birol, the agency's executive director.

If everything announced today is built, the investment flowing into manufacturing clean energy technologies will provide two-thirds of the money needed to achieve net zero emissions. The current momentum brings us closer to meeting our international energy and climate goals, and there will almost certainly be more to come. However, the high concentration of resources and technology in certain countries poses risks to global supply chains, the report said.

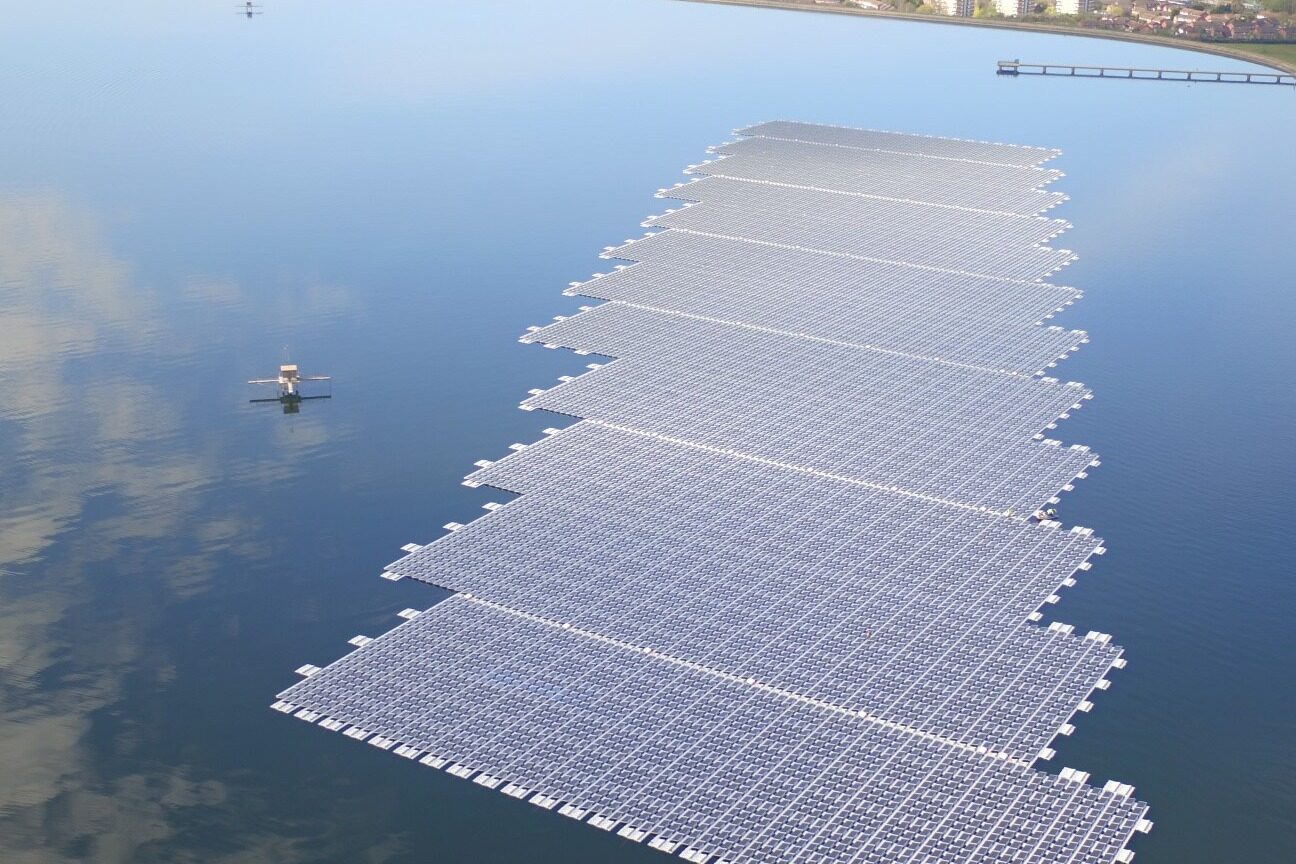

Over the past two years, the lockdown in China, the world's second-largest economy and the largest maker of solar modules, has severely disrupted global supply chains. The agency said in a 2022 report that it expects the country to invest $90 billion in its solar PV supply chain between 2022 and 2027, more than three times the investment expected in the rest of the world combined.

Electric vehicles, seen as vital to global net-zero emissions efforts, rely on a range of key minerals sourced from a handful of countries such as the Democratic Republic of Congo, Australia and China. The world would benefit from a more diversified cleantech supply chain, Mr Birol said.

As we saw with Europe's dependence on Russian gas, when you become overly dependent on one company, one country or one trade route - if there is disruption, you risk paying a heavy price. Major economies are taking action to integrate their climate, energy security and industrial policies into broader strategies, the report said.

The Lower Inflation Act in the U.S. provides a host of tax incentives for wind, solar, hydro and other renewable energy sources and boosts electric vehicle ownership. With the help of the scheme, the EU plans to cut demand for Russian gas by two-thirds by the end of the year, mobilizing up to 300 billion euros in investment. India, the world's third-largest importer of crude oil, aims to produce 500 GW of non-fossil fuel capacity by 2030 to meet half of its energy needs from renewable sources.

Only 25% of announced solar PV manufacturing projects globally are under construction or about to start construction, the agency said. That figure is about 35 percent for EV batteries and less than 10 percent for electrolyzers, a key technology for producing low-emission hydrogen.Editor/Xing Wentao

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~