- Since 2023, the exchange rate of the RMB has fallen again, which has refreshed many people's perceptions

- Some major oil countries in the Middle East announced that they will use RMB for settlement in the future

Recently, the renminbi has unexpectedly fallen sharply, and the exchange rate has fallen for four consecutive weeks. Many countries have become worried and even at a loss. Then why did it fall? Of course, it is because the Fed may raise interest rates sharply again in the near future, and the rate of interest rate hike in March is likely to return to 50 basis points. Today, the inflation in the United States is still not controlled within a safe range, so even if the interest rate hike has a particularly large impact on the U.S. economy, the Fed must resolve the inflation problem first. After all, it will be difficult for the bottom of the United States to deal with it if prices soar. up. Originally, when the interest rate was raised for the first time in 2023, it was only increased by 25 basis points. Market expectations have eased, but the United States still lost to stubborn inflation. For example, the renminbi is still performing well. Under normal circumstances, it will fall more or less, but it will eventually stabilize and fluctuate within a normal range.

Many economic institutions in the United States predict that the RMB may fluctuate between 6.7 and 7.0 in 2023. I believe that in the future, as inflation in the United States is gradually brought under control, interest rate hikes will be slowed down, and even after interest rates are cut, the renminbi can completely rise again, and you don’t need to worry about it at all. What's more, the renminbi has ushered in a great benefit. The future appreciation of the renminbi has laid a solid foundation. This benefit is: Now the two major oil-producing countries have announced that they will use RMB for direct settlement.

Central Bank of Iraq Announces Allowing RMB Settlement

On February 22, 2023, the Central Bank of Iraq issued a statement stating that it would allow trade from China to be settled directly in RMB. Iraq has stipulated two plans for preparing RMB transactions with China: one is to increase RMB reserves through the RMB accounts opened by the country’s banks in Chinese banks; Bank reserves of U.S. dollars, which are exchanged for yuan.

Modir Saleh, an economic adviser to the Iraqi government, told Reuters on Wednesday: This will be the first time that Iraq's imports from China have been priced in yuan. Previously, Iraq's imports (trade) from China had been settled in dollars only. Saleh also said that the Central Bank of Iraq's new measures apply to the private sector's import trade, excluding oil trade. The Arab businessman website recently stated that the new measures by the Central Bank of Iraq are aimed at stabilizing the Iraqi dinar, which has depreciated against the US dollar in recent months, as part of measures to obtain foreign exchange.

Iraq is currently facing a shortage of U.S. dollars, partly because the Federal Reserve has stepped up restrictions aimed at preventing the transfer of dollars from Iraq to neighboring Iran, which is under U.S. sanctions. The shortage of funds has caused the Iraqi dinar street currency to fall against the U.S. dollar. At present, China is Iraq's largest trading partner, and Iraq is China's third largest trading partner among Arab countries. According to Chinese customs data, in 2022, the bilateral trade volume between China and Iran will exceed US$53.7 billion, an increase of about 44% compared with the trade volume in 2021 (US$37.3 billion). In 2022, China will import about 55.487 million tons of crude oil from Iraq.

Iraqi economists predict that the acceptance of RMB settlement will be very high, because many businessmen hope to get rid of the control of the US dollar, and Iraqi businessmen are under great pressure to exchange currencies, and they hope to get rid of the shackles of the Federal Reserve. The Central Bank of Iraq decided that it is necessary to switch from US dollars to RMB to settle trade with China, and this move will also help to further expand trade volume. Mashhadani said: Over the years, Iraqi companies and China have maintained good cooperation. If the settlement mechanism is more convenient, I believe that the cooperation between the two sides will be closer.

Iraq is another Middle Eastern country that uses RMB to settle trade with China, which shows that the international status and influence of the RMB has been further enhanced, and the process of RMB going global and realizing internationalization has taken another important step. While the U.S. dollar remains the world's number one reserve currency, its lead has declined in recent years. The IMF's research report released earlier in 2022 showed that over the past 20 years, global central banks have reduced the dollar's share of their foreign exchange reserves, with a quarter of the reduction going to the renminbi. China's dominance in global trade is increasing the yuan's share of global central bank reserves. Experts said: With the strengthening of China's economic strength, the influence of the RMB is increasing day by day, and the increase in the proportion and scale of the RMB is an irreversible trend.

Saudi oil trade with China to be settled in yuan

Next, let’s talk about the second country, Saudi Arabia. At the China-Arabia summit held at the end of 2022, the oil trade between Saudi Arabia and China will be settled in RMB. At present, China and the Middle East countries mostly use currency swaps. The oil transactions between Saudi Arabia and China at the summit will be settled in RMB, which will have a demonstration effect on the Middle East countries. Cross-border payment and RMB internationalization are bound to usher in a new pattern. Saudi Arabia is the largest source country of China's oil imports. At the same time, Saudi Arabia is also China's largest overseas project contracting market in the Middle East and North Africa region, and it is also the largest trading partner in the Middle East and North Africa region.

In the context of the Russia-Ukraine conflict, U.S. President Biden repeatedly asked Arab countries to increase oil production, but Saudi Arabia responded by cutting output by 2 million barrels per day. This shows that the petrodollar agreement, which is the foundation of the U.S. dollar, has cracked. Moreover, Saudi Arabia has made it clear many times recently that it wants to join the Shanghai Cooperation Organization, and China also expressed its support for Saudi Arabia to join the Shanghai Cooperation Organization at this summit. China-Saudi Arabia and even China-Arabia will also accelerate the construction of a new pattern of all-round, multi-level and wide-ranging cooperation. According to previous reports, this China-Arab summit is the first summit between China and an Arab country.

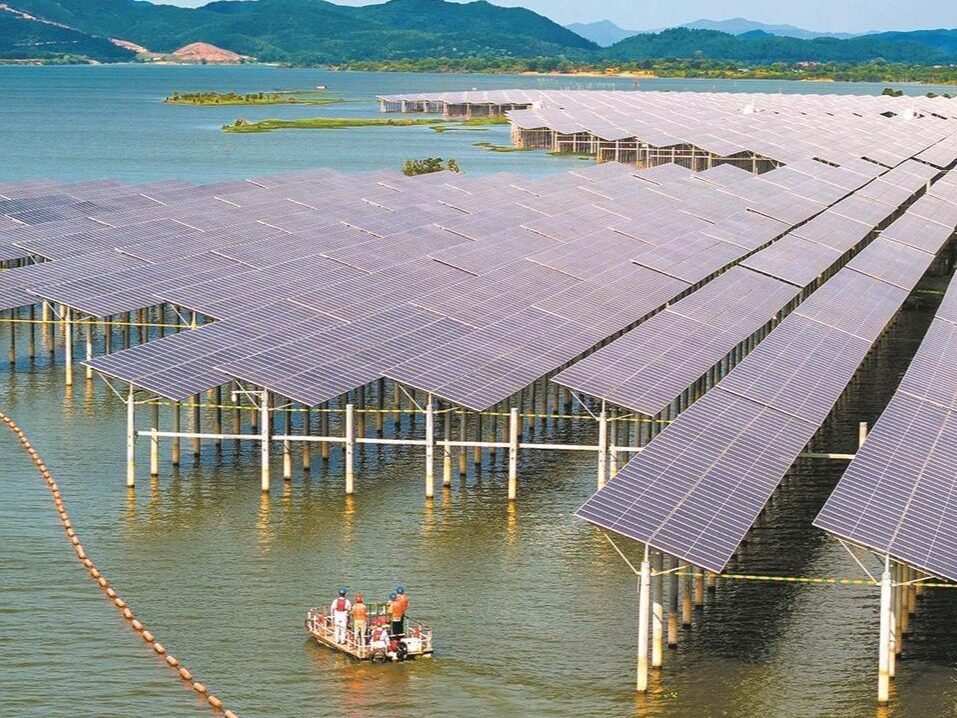

The most important cooperation between China and Saudi Arabia is in energy, so it is very important to be able to use RMB to directly purchase Saudi crude oil. In 2021, China will import 26 billion tons of crude oil from Arab countries as a whole, accounting for 51.47% of China's total crude oil imports in the same period. At this stage, the "Oil and Gas +" cooperation model between China and Arab states has been further promoted, forming a whole industry chain cooperation of oil and gas exploration, exploitation, refining, storage and transportation, and building a number of energy industry infrastructure projects and large-scale operation projects. It is also worth noting that Saudi Arabia and other Arab countries import new energy equipment and technology from China. Saudi Arabia also proposed to transform to clean energy. As we all know, China is the world's leading country in new energy technology. Not only is the technology advanced and the price is right, but also the new The huge energy production capacity is enough to meet the energy transformation needs of Saudi Arabia and all Arab countries, so that traditional energy countries will not fall behind in the new energy era.

According to the agreement, China-Saudi Arabia new energy cooperation will focus on solar energy, wind energy and hydropower. my country's photovoltaic industry is mature, with continuous deserts in Arab countries, abundant sunlight, cheap land, and extremely low power generation costs, and photovoltaic cooperation projects are progressing smoothly. Previously, China and Arab countries have cooperated in the construction of projects such as the Halsa photovoltaic power station put into operation for the World Cup in Qatar, the Egyptian photovoltaic power generation base, the China-Arab clean energy training center, and the China-Egypt renewable energy joint laboratory. In terms of hydropower, the construction of tidal power generation along the four coasts of the Arabian Peninsula, including the Red Sea and the Sea of Oman, is the direction of cooperation; in terms of nuclear power, the United States, Europe and Israel have always opposed the development of the nuclear power industry in Arab countries. At present, Chinese companies have signed agreements with the United Arab Emirates, Saudi Arabia and Sudan. The agreement on the peaceful use of nuclear energy is expected to accelerate in the future.

In the context of the country's further promotion of external circulation and the construction of the Belt and Road Initiative, the China-Saudi Arabia summit will be a milestone meeting in the Middle East Belt and Road Initiative, especially in the RMB pricing of crude oil has made great progress. Combined with previous news, China has been rapidly advancing its search for RMB pricing for resources through its huge industrial market. Among them, China has sought to adopt the Shanghai Nickel pricing of the Shanghai Futures Exchange when trading with Chinese counterparties for metals such as nickel. The RMB pricing of crude oil is a big step forward, and the internationalization of the RMB is an important milestone for energy security. In addition, this summit has also enabled Chinese enterprises in new energy to gain a huge market.

Iran, which was farsighted earlier than Iraq and Saudi Arabia, had already adopted the RMB settlement method with China in part of its oil trade in 2012. Today, the cooperation between China and Iran is also mainly concentrated in the energy field. Iran has been struggling to survive under the sanctions of the United States for many years. China's cooperation has provided it with a relatively stable economic source. In addition to RMB settlement, Iran also plans to replace part of its US dollar reserves in overseas banks with RMB. Obviously, Iran is more confident in China's future economic development. After all, only a stable currency becomes a national reserve currency. With Iran, Iraq, and Saudi Arabia leading the way, the Middle East has taken another step towards getting rid of the US dollar and entering the ranks of RMB settlement.

The international market is ever-changing, and China's cooperation in the energy market, finance, supply chain, and infrastructure has benefited many countries in the Middle East. Sovereign wealth funds in the Middle East have also set up a team dedicated to investing in the Chinese market. It can be said that funds in the Middle East are intensively sweeping up Chinese assets. In this way, if you look back at the recent fall in the RMB exchange rate, you will not be very worried, because this is only a short-term fluctuation. The main reason is that the expectation of a 50 basis point increase in the US interest rate has become larger, and the US dollar index has strengthened again. And the benefits brought by RMB settlement have been recognized and accepted by more and more Middle Eastern countries.Editor/Ma Xue

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~