- As of January to May 2023, Russia is still the largest export market for Chinese construction machinery

- From January to May, the total export of complete machines was 14.602 billion US dollars, an increase of 42.4%, accounting for 70.4% of the total export

At present, the construction machinery industry is facing some challenges and opportunities, domestic sales pressure export growth momentum is obvious. According to customs data, from January to May 2023, China's import and export trade volume of construction machinery was 21.841 billion US dollars, an increase of 27.2%. Among them, the import value was 1.091 billion US dollars, down 12.9%; The export value was US $20.751 billion, an increase of 30.4%, and the trade surplus was US $19.66 billion, an increase of US $5.04 billion.

Imports in May 2023 were $247 million, down 1.12% year-on-year; Exports reached 4.483 billion US dollars, up 30.4% year on year. The total value of imports and exports in May was 4.73 billion US dollars, up 28.2% year on year.

Total machine exports increased by 42.4% year-on-year

In terms of imports, from January to May 2023, imports of parts and components were 754 million US dollars, down 4.1% year-on-year, accounting for 69.2% of the total imports. Imports of complete machines amounted to US $336 million, down 27.8% year-on-year, accounting for 30.8% of the total imports. The main products of import growth are: crawler excavators, stackers, bulldozers below 320 horsepower. The main decline in imports are: tunnel boring machines, pile drivers and construction RIGS, other construction vehicles, loaders, rock drilling machinery and pneumatic tools, concrete mixing machinery, pavers, off-highway dump trucks, etc.

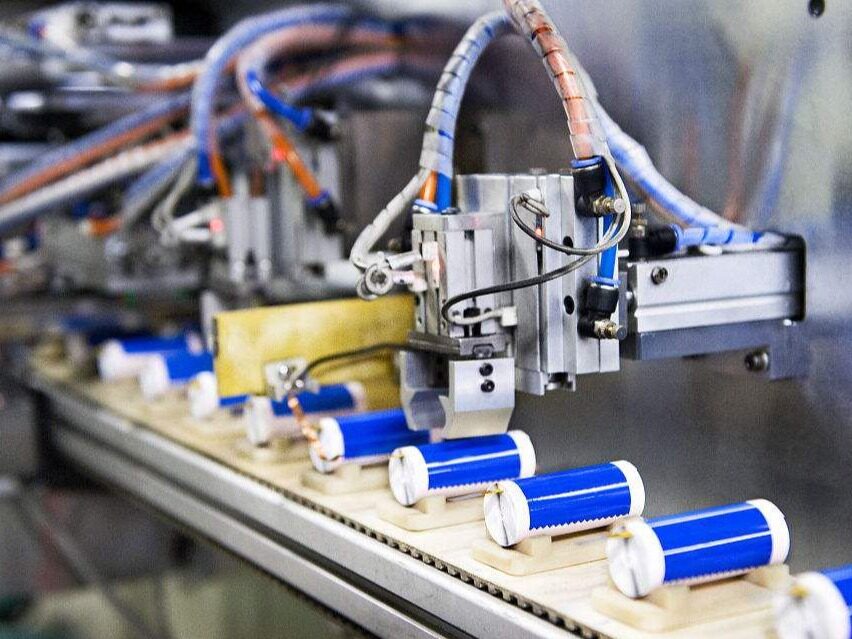

In terms of exports, the total export of complete machines was 14.602 billion US dollars, an increase of 42.4%, accounting for 70.4% of the total export; The export of parts and components was 6.149 billion US dollars, an increase of 8.69%, accounting for 29.6% of the total export. From January to May, the main machine exports increased are: crawler excavators, electric forklifts, loaders, internal combustion forklifts, other truck cranes, elevators and escalators, off-highway dump trucks, etc. Exports decreased mainly: concrete pump trucks, pile drivers and engineering drilling RIGS.

Russian Federation, India, Africa and Latin America regional markets from January to May saw a large increase in exports

From January to May 2023, China's construction machinery exports to six continents showed a different trend of differentiation, of which the export growth was larger, especially to export to Europe 5.864 billion US dollars, an increase of 65.1%, and the proportion of exports was 28.26%. In addition, Asia, which accounted for a large proportion of exports, reached US $8.286 billion, accounting for the highest proportion of 39.93% of the total exports, an increase of 23.5%. Exports to South America $1.696 billion, an increase of 22.1%, exports to Africa $1.841 billion, an increase of 22.6%, accounting for 8.87%. The lower growth rate of exports is: North America US $2.226 billion, an increase of 12.8%, accounting for 10.73%; Exports to Oceania amounted to 839 million US dollars, up 6.78% year-on-year, accounting for 4.04%.

From surpassing to continuing to lead, as of January to May 2023, Russia is still China's largest export market for construction machinery. Previously, in January-February 2023, China's total export of construction machinery products to Russia exceeded the United States by $809 million, and Russia became China's largest single country export market for construction machinery. (Russia surpassed the United States to become the largest export market for Chinese construction machinery) The specific data is as follows:

From January to May 2023, exports to the Russian Federation were 2.848 billion US dollars, an increase of 217.71%; Exports to India $735 million, an increase of 35.1%; Exports to Africa and Latin America reached 3.536 billion US dollars, up 22.4% year on year; Exports to ASEAN reached 3.214 billion US dollars, up 9.9% year on year; Exports to the EU and the UK amounted to US $2.867 billion, up 13.9% year on year; Exports to the United States $1.862 billion, an increase of 12.65%, accounting for 8.97%.

In terms of main export countries, the Russian Federation continued to enhance its position in the single largest export market of China's construction machinery, and the proportion of exports further increased to 13.72%. Saudi Arabia and Turkey both increased by more than 100%, making them the fastest growing single country markets. In addition, China's exports to the Netherlands, Malaysia and Mexico also increased relatively high.

The top 20 major export target countries accounted for 69.4% of total exports. From January to May 2023, China's construction machinery exports to countries along the "Belt and Road" totaled 9.919 billion US dollars, accounting for 47.8% of all exports, an increase of 53.3%. Exports to BRICS countries reached $4.43 billion, accounting for 21.35% of total exports, up 102.38% year-on-year. Among them, the main source countries of imports are still Germany and Japan, and their cumulative imports from January to May are more than 200 million US dollars, accounting for more than 20%. South Korea followed with 13.8 per cent. The value of imports from the United States, Italy and Sweden is more than 50 million US dollars.

The main characteristics of import and export of construction machinery products from January to May 2023

Construction machinery exports to maintain a good momentum. Affected by the continued strong demand in the international market and the base of last year, the export growth rate from January to May continued to maintain a high level. In particular, the export volume in April increased by more than 65%, and the Russian market continued to accelerate growth, leading the European market demand growth in all continents. Other major markets Saudi Arabia, Turkey, Mexico, the Netherlands, Malaysia, India also maintained relatively high growth rates.

Imports were stable. In January-February 2022 and 2023, there were several consecutive months of imports below the level of 200 million US dollars, and the import volume from March to May was stable above 200 million US dollars, the decline narrowed to a single digit, and the first quarter was -5.62%; April and May were only -1.62% and -1.12% respectively, and the decline in imports from January to May further dropped to 12.9%, the lowest in the previous 16 months. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~