- The upstream expansion of the photovoltaic industry is huge, and there have been some signs of overheating

- The main driving force to stimulate the upstream expansion of the photovoltaic industry chain is the skyrocketing end demand

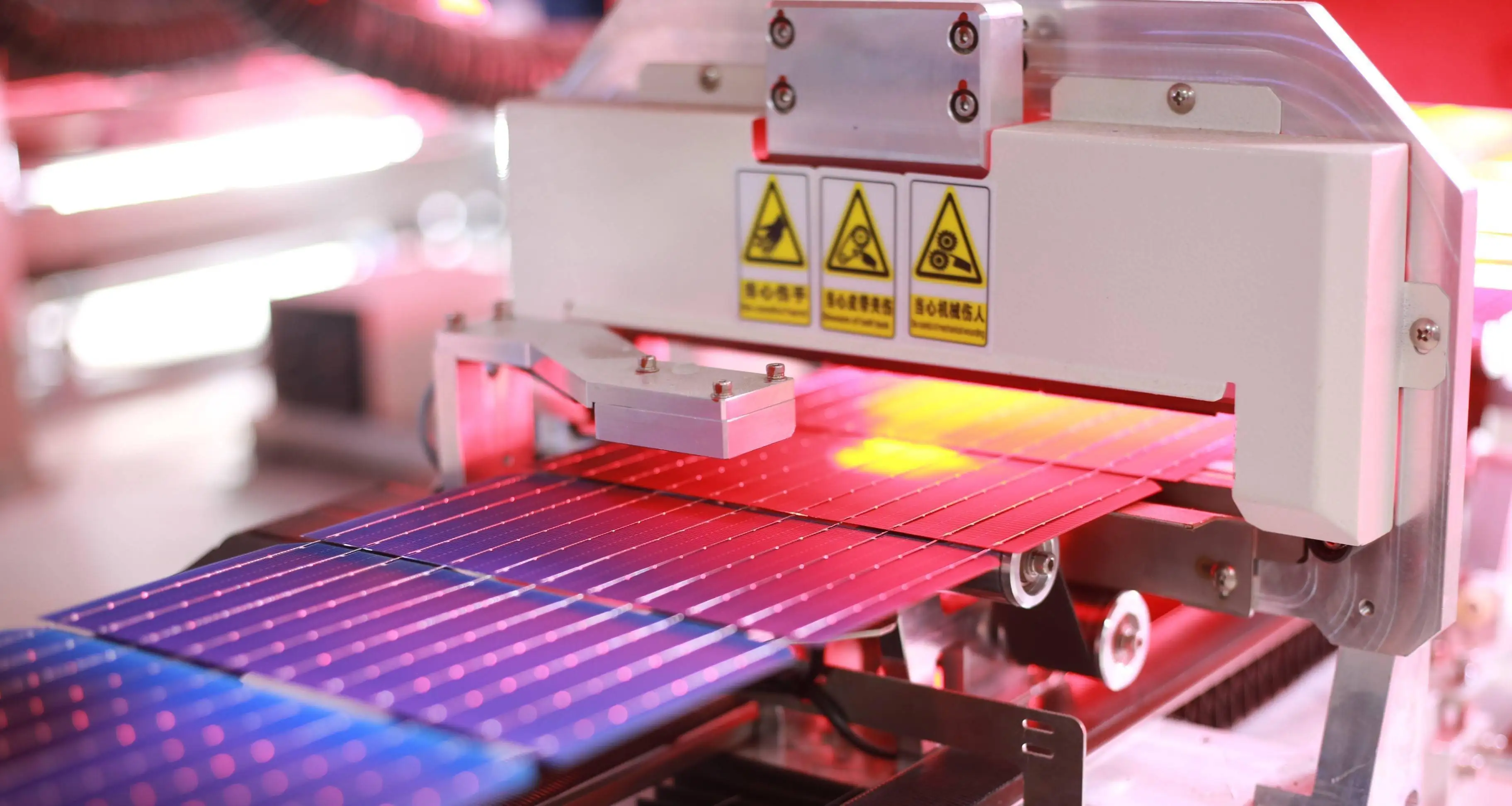

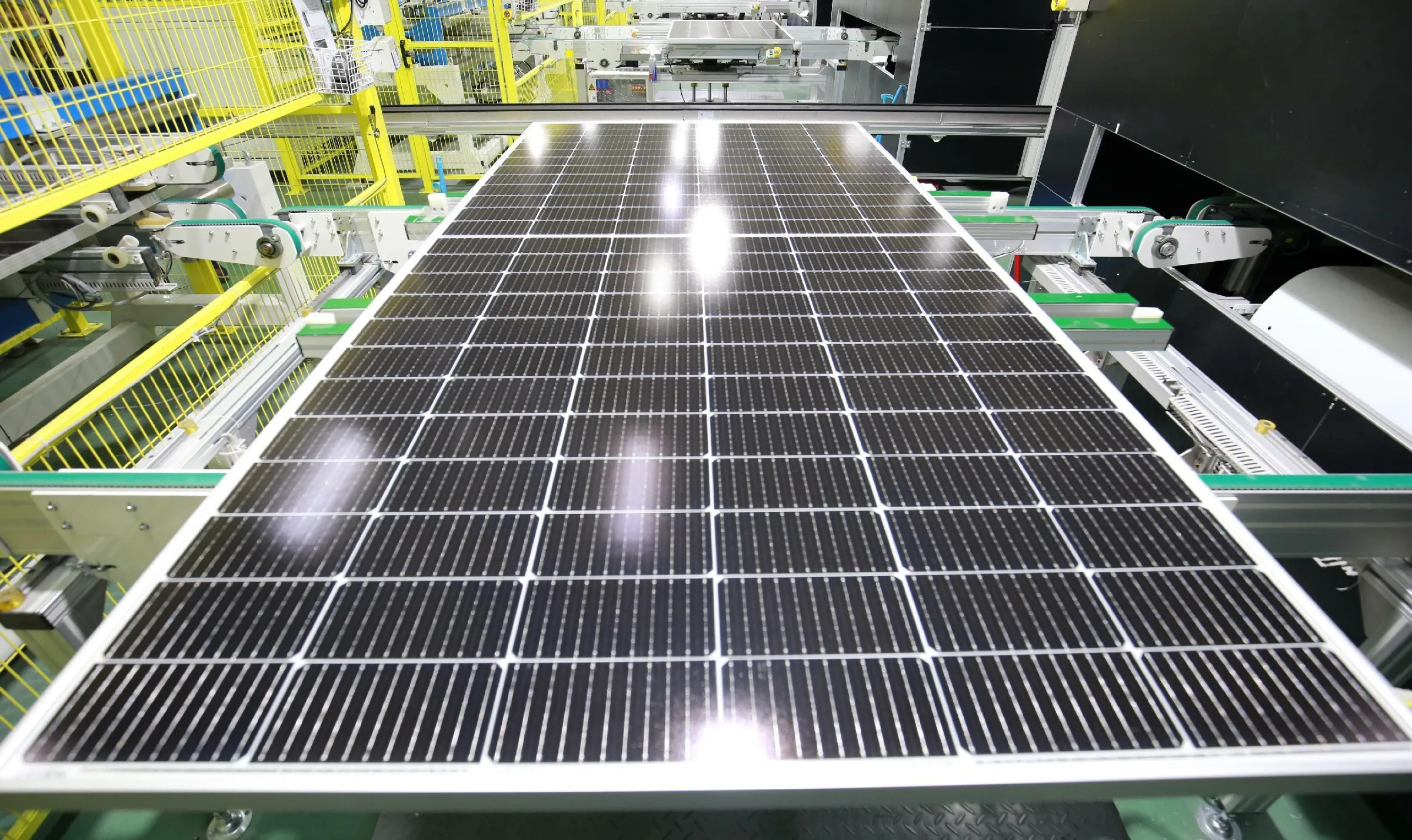

The world energy landscape has changed, and China's photovoltaic industry has flourished by taking advantage of the dual-carbon wind. Countless stunning data continue to stimulate the nerves of many people inside and outside the industry: from January to June, the newly installed photovoltaic capacity exceeded 78GW, almost equal to the whole year of 2022; In the first half of 2023, the production of silicon wafers, batteries and components expanded to nearly 1500GW; In the first half of the same year, 60 photovoltaic companies launched nearly 200 billion yuan of financing, quadrupling from the whole year of 2022.

This is undoubtedly the most enviable track. However, under the situation of fire cooking oil, the anxiety of the photovoltaic industry is spreading rapidly. As early as the snec exhibition, a number of industry leaders have warned of the industry crisis, and even predicted that more than half of the enterprises in the next two or three years may be eliminated.

Obvious overcapacity

The huge and almost frenzied expansion is clearly causing the most anxiety in the industry. According to data, as of the end of 2019, China's photovoltaic module production capacity is about 219GW, but in just three and a half years, the scale of module expansion has reached thousands of GW, and other links are even worse.

According to the forecast of third-party consulting institutions, the total capacity of polysilicon (supporting downstream capacity), silicon wafers, batteries, and components will exceed 800GW by the end of 2023, while the global new installed capacity is 350~400GW, and excess capacity is in sight.

At the seminar on the development review of the photovoltaic industry in the first half of 2023 held by the China Photovoltaic Industry Association and the outlook for the second half of the year, Xing Yiteng, director of the new Energy Department of the New Energy and renewable Energy Department of the National Energy Administration, reminded that the upstream expansion of the photovoltaic industry is huge, and there have been some signs of overheating, and the risk of industry ups and downs has increased.

On the one hand, excess capacity and massive expansion on the other hand, such internal roll-type expansion lies in the positive photovoltaic technology iteration period, and enterprises have increased the capacity of the next generation of N-type technology in advance. Therefore, the expansion of the army, the head of the enterprise is equally fierce. Since 2023, Longi, Jinko, JA, and Artus have all thrown out a gigawatt expansion plan.

At the same time, under the capital support, cross-border enterprises have poured into the expansion army, Zhengqi Holding, Zhuhai Hongjun, Tian Chen Shares, Ming brand jewelry, East China Heavy machinery...... And the corner overtaking, new players mostly gamble n type. It is said that an equipment company has placed orders for TOPCon as high as 700GW.

On the other hand, Xing Yiteng also pointed out that the mandatory binding of industries before the allocation of new energy projects has intensified the chaos of expansion. In this regard, some companies have confirmed that some expansion is actually a helpless move, and there are many variables in the project landing.

In fact, the growing overcapacity seems to have reawakened the painful memories of the industry's great depression more than a decade ago. From 2011 to 2012, the United States and Europe successively offered a double back stick to China's photovoltaic industry, at that time, China's photovoltaic manufacturing was highly dependent on overseas markets, which led to large-scale corporate closures. Following past reports, only in 2012, the number of manufacturers in the important link of the photovoltaic industry chain dropped from 901 to 704, directly pushing the hand for the double back stick, the fundamental reason is overcapacity.

Pull back to the present, Wang Bohua, honorary chairman of the China Photovoltaic Industry Association, pointed out that China's photovoltaic products exports still account for 60%, but the form of international trade is more complex, in addition to lingering trade barriers, the United States, Europe, India and other countries began to support local manufacturing. The International Energy Agency (IEA) predicts that before 2024, China's photovoltaic manufacturing will still dominate the world, but in 2027, China's photovoltaic capacity is expected to decline by 5%, and the output proportion will decline by 15%.

Attention to the overcapacity crisis has also become a common call in the industry. Qian Jing, vice president of Jinkosolar, said that the development of enterprises cannot be separated from enthusiastic capital, policies and public opinion, but the development of the industry needs rational capital, policies and public opinion, only the industry is sustainable, the enterprise will be sustainable.

In the 2023 photovoltaic industry supply chain development (Xuancheng) forum, Trina Solar chairman Gao Jifan judged that 2023~2025, the global photovoltaic market will still grow at a high speed, but then the growth will slow down, when the incremental decline, if the enterprise continues the current development inertia, or the price of polysilicon in a short period of time.

In Gao Jifan's view, the head enterprise that has established a competitive advantage will continue to have a dominant position in the next three to five years, but the path of emerging enterprises is differentiation, if and head enterprises compete with homogeneous products, the chance of success is minimal.

Of course, there are different voices. Yao Yao, chief analyst of the new energy and automotive research department of Guojin Securities, stressed that excess is the normal state of the photovoltaic industry, and even excess is one of the core drivers of technological innovation in the industry, in the state of excess, the leading advantages of most links in the industrial chain will show an amplified trend.

Vital grid access

The main driving force to stimulate the upstream expansion of the photovoltaic industry chain is the skyrocketing end demand. At the beginning of the year, the National Energy Administration set a goal that the new installed capacity of 2023 will reach 160 million kilowatts, an increase of more than 33%. Only in the first half of 2023, the new installed capacity of scenery has exceeded 100 million kilowatts, of which photovoltaic is surging, an increase of 154%.

As a result, the China Photovoltaic Industry Association raised the expected 2023 photovoltaic installed capacity, the domestic new installed capacity increased from 95~120GW to 120~140GW; Global new installed capacity increased from 280 to 330GW to 305 to 350GW.

With the rapid increase of new energy installed capacity, according to statistics, in 2025, including Qinghai, Gansu, Ningxia, Hebei and other provinces, the proportion of new energy installed capacity will exceed 60%.

The high proportion of new energy will pose serious challenges to the stability of power grid. At the seminar on the development review of the photovoltaic industry in the first half of 2023 and the outlook of the situation in the second half of the year, Wang Xinxuan, director of solar power solutions, introduced that the new energy transient active power and voltage support are insufficient, and the power transfer after the failure of HVDC transmission is large area, causing the voltage collapse. In addition, the high proportion of new energy access, peak and frequency regulation, transient voltage, broadband oscillation, etc., all pose challenges to the power grid.

The strength of the power grid has declined, and future power grid access will be the main bottleneck for new energy installation. Distributed photovoltaics connected to the grid with low voltage will bear the brunt. Such as Yingkou, Liaoning Province recently issued a notice to suspend the city's new distributed photovoltaic project filing work, the main reason is that the photovoltaic capacity has been filed unconnected to the grid has far exceeded the local distributed power supply can access the carrying capacity. In fact, Liaoning Yingkou dilemma has been staged in many places.

Distributed photovoltaic development and consumption mechanism, in the above industry conference, Li Qionghui, director of the New energy and Statistics Institute of the State Grid Energy Research Institute, said that the market exploration mode includes confluence + energy storage access, decentralized nearby access, spontaneous self-use surplus electricity online and grid-connected microgrids.

Have to enter the market transaction

Market trading is one of the important means to promote the consumption of new energy power. According to the top-level plan, by 2030, the national unified electricity market system will be basically completed, new energy will fully participate in market trading, and power resources will be further optimized and allocated nationwide.

However, looking at the present, new energy power plants are generally in a dilemma to participate in power trading. When signing a medium - and long-term contract with a power sale company, the output curve cannot meet the normal electricity demand alone, and the ideal medium - and long-term contract price cannot be reached, while spot trading, when the photovoltaic power generation (noon), the spot market price is often very low, and the income is not ideal.

Since 2023, Shandong's negative electricity price has been repeatedly brushed on the hot search. What has caused widespread discussion in the industry is that from 20 on May 1 to 17 on May 2, the real-time market of Shandong Electric Power has a continuous negative electricity price for 21 hours, refreshing the long period spot trial operation of negative electricity price time record.

According to the new media analysis of the union, the negative electricity price in Shandong on May 1 and 2 did not have a big impact on both sides of the issue. First of all, the so-called continuous 21 hours of negative price occurs in the real-time market, the day before the market of Shandong power spot market is the full market, and locked the price, the real-time market and the day before the market only do deviation settlement, 21 hours of negative price period corresponding to the day before the market only 17 hours; Secondly, Shandong power market has designed a capacity recovery mechanism. If the capacity recovery mechanism is paid and the progress electricity is shared, there is only one period (15 minutes) of real-time electricity price negative on May 1 and 2 according to this calculation method (not considering the capacity cost paid between various entities). Finally, medium - and long-term contracts need to be settled with the daily market results, taking into account the medium - and long-term contract factors, and no power generation entity ultimately pays for power generation on the settlement.

However, from the experience of the international market, with the large-scale grid connection of new energy, the price of electricity for consumption, zero electricity price, negative electricity price events or will become more frequent. This also indicates that the future new energy investment will be changed from the certainty to uncertainty, and the investment strategy, income measurement model, and operation of enterprises will be changed.

And not only centralized photovoltaic, Xing Yiteng revealed that with the rapid expansion of distributed photovoltaic scale, the insufficient capacity of the distribution network is prominent, and distributed photovoltaic participation in the power market has been put on the agenda. Back to the beginning, the construction of a new power system based on new energy can not be the healthy development of the industrial chain, or the reform of the power system and mechanism, which is still hindered and long. Editor/Xu Shengpeng

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~