- CNOOC plans to further consolidate its reserves and resource base in 2021 and steadily promote oil and gas reserves and production

Oil is known as the blood of industry and the source of power for modern civilization and economic development. On February 4, 2021, China National Offshore Oil Corporation announced its 2021 business strategy and development plan.

2020 is an extraordinary year. Under the leadership of the board of directors, the company’s management led all employees to overcome the huge impact of low oil prices and the new crown pneumonia epidemic, strictly implemented epidemic prevention and control measures, vigorously promoted the increase in reserves and production, in-depth development of cost reduction and efficiency enhancement, and solid progress in reform and innovation. To ensure safe production, the company's net output in 2020 will reach approximately 528 million barrels of oil equivalent, a record high. CNOOC said that in 2021, CNOOC’s capital expenditure budget will total RMB 90-100 billion, which will further consolidate the resource base of reserves. The net production target for 2021 is 545-555 million barrels of oil equivalent. In 2022 and 2023, the company's net production targets are 590-600 million barrels of oil equivalent and 640-650 million barrels of oil equivalent, respectively.

90-100 billion yuan in capital expenditure

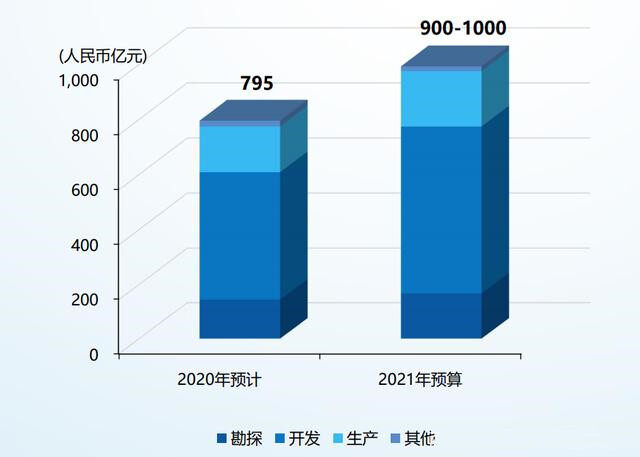

In 2021, CNOOC’s total capital expenditure budget is RMB 90-100 billion. Compared with the capital expenditure of about 79.5 billion yuan in 2020, the increase in 2021 will be 10.5-20 billion yuan, which exceeds the growth rate of the same period in previous years and also exceeds market expectations for CNOOC. CNOOC CFO Xie Weizhi said that the 2021 capital expenditure budgeted oil price is based on Brent 50 US dollars per barrel.

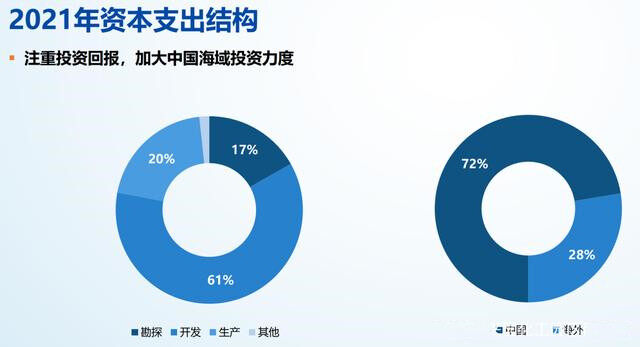

Among them, exploration, development and production capitalization expenditures are expected to account for approximately 17%, 61% and 20% of the total capital expenditure budget respectively. In the allocation of capital expenditure in 2021, the proportion of capital expenditure used for oil and gas field development was slightly higher than that of previous years, while the proportion used for exploration was slightly lower than that of previous years. In this regard, Xu Keqiang explained that the actual exploration workload of the company has not decreased, while the increase in development expenditure is due to the development of multiple key projects this year.

In terms of the allocation of capital expenditures at home and abroad, CNOOC CFO Xie Weizhi said that the company will increase investment in China's waters. In 2021, China and overseas expenditure will account for 72% and 28% respectively. "Exploration is the leader of the company's various businesses. The company's exploration strategy in China's waters is to simultaneously develop oil and gas and tilt toward gas; overseas exploration focuses on strategic core areas, and both operators and non-operator projects are equally important."

Increase exploration and development

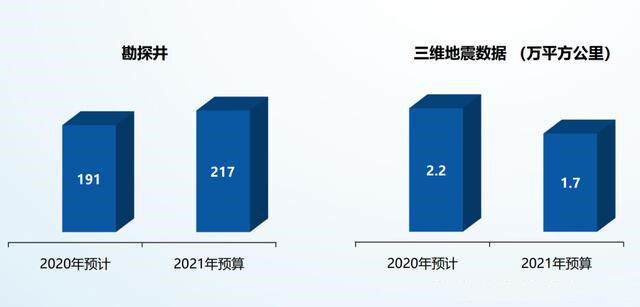

Increasing exploration and development is still the main keynote of CNOOC in the future. From the perspective of exploration workload, CNOOC's exploration workload in 2021 will focus on finding large and medium-sized oil and gas fields to achieve sustainable development of exploration. CNOOC plans to drill 217 exploration wells in 2021, and plans to collect approximately 17,000 square kilometers of 3D seismic data.

In terms of exploration strategy, in China's seas, oil and gas are simultaneously developed and tilted towards gas; stabilize the middle and shallow layers, increase the middle layer, and actively prepare for the deep layer; increase risk exploration efforts to achieve multiple breakthroughs in new areas and new areas. Overseas, gather strategic core areas, and pay equal attention to operators and non-operators.

From the perspective of production targets, CNOOC is expected to achieve 545-555 million barrels of oil equivalent in 2021, of which petroleum liquids account for 80% and natural gas account for 20%. The targets for 2022 and 2023 are 590-600 million barrels of oil equivalent and 640-650 million barrels of oil equivalent, with an average annual increase of about 40-50 million barrels of oil equivalent, which is more than the average of the past few years.

According to the plan, CNOOC will have 19 new projects put into production in 2021 to support future production growth, mainly including the development of the Lingshui 17-2 gas field group in the Chinese seas, the regional development of the Lufeng oil field group, the Caofeidian 6-4 oil field, and the second phase of the Buzzard oil field in the United Kingdom. , Brazil’s Mero Oilfield Phase I, etc.

Green and low carbon transition

On January 15, CNOOC Group announced that it will officially launch the carbon neutral plan, which will fully promote the company's green and low-carbon transformation. During the "14th Five-Year Plan" period, CNOOC will focus on improving the supply capacity of natural gas resources and accelerating the development of new energy industries, and promote the realization of clean and low-carbon energy to increase the proportion of more than 60%.

In the 2021 business strategy and development plan, CNOOC once again focused on vigorously promoting green and low-carbon transformation.

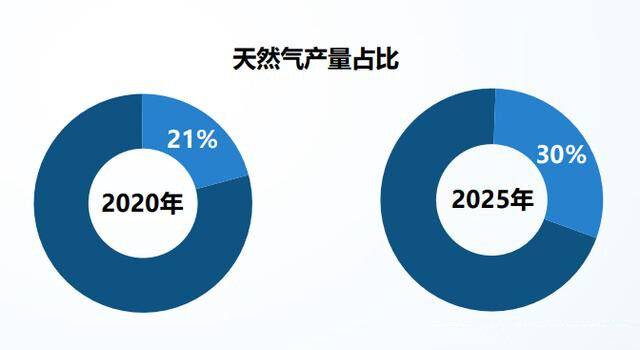

On the one hand, we insisted on stabilizing oil and gas, continuously increasing natural gas exploration and enhancing natural gas supply capacity. Promote the key natural gas projects of Lingshui 17-2 and Bozhong 19-6, and strengthen the development of unconventional gas on the mainland. In 2020, natural gas will account for 21% of CNOOC's production. According to the plan, by 2025, the proportion of natural gas production will increase to 30%.

On the other hand, it actively explores the development of new energy, and chooses new energy business "focusing on the sea" differentiatedly. According to the plan, in the future, CNOOC will invest about 5% of capital expenditures in the field of new energy, and will promote the offshore wind power business in a steady and orderly manner, and carry out research in the corresponding cutting-edge technology fields.

With the rapid economic development in China, the problem of energy shortage is becoming increasingly prominent. In 2021, the company will continue to focus on high-quality development, steadily promote oil and gas reserves and production, focus on investment efficiency, consolidate cost competitive advantages, and actively implement the concept of green and low-carbon development to return shareholders with outstanding performance. Editor/Sang Xiaomei

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~