- In 2020, the newly installed capacity of global wind power will be 96.3GW, and Chinese enterprises will occupy seven seats

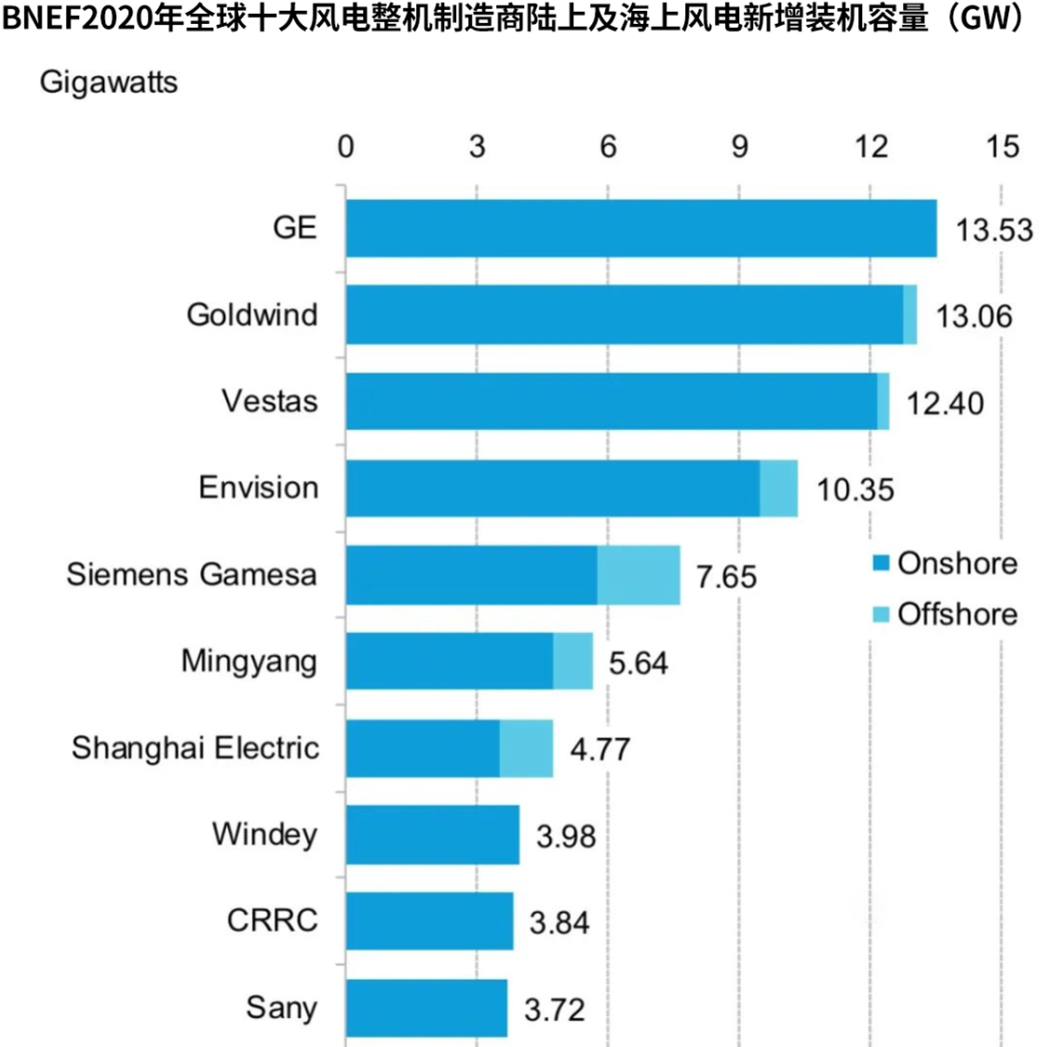

Recently, the market share ranking of global wind power machine manufacturers in 2020. Data show that the newly installed capacity of global wind power will be 96.3GW in 2020, an increase of 59% compared to 2019. GE replaced Vestas in the top spot in the world. China's OEMs Goldwind Technology and Envision Energy ranked among the top four, and the newly added lifting capacity exceeded 10GW. In addition, 6-10 were all taken over by Chinese companies.

The home market is the cornerstone

The changes presented on the list once again show that the local market is the cornerstone. In 2020, both the Chinese market and the U.S. market will reach new highs in new wind power installed capacity, which directly contributed to GE's summit and batches of Chinese companies entering the top ten.

The reason why GE can replace Vestas to the top of the world is inseparable from the rapid growth of its installed capacity in the US domestic market. In the same way, seven Chinese companies are among the top ten in the world, also benefiting from the record-breaking installed capacity brought by China's wind power market in 2020.

Dark blue represents onshore wind power, light blue represents offshore wind power

According to the ranking data of the newly added hoisting capacity of Chinese wind power manufacturers in 2020, due to the subsidy decline and the impact of the "30·60" dual-carbon target, the new hoisting capacity of China's wind power in 2020 will reach 57.8GW, which will be achieved on the basis of 2019 Doubled. Among them, onshore wind power added 53.8GW, a year-on-year increase of 105%; offshore wind power added 4GW, a year-on-year increase of 47%.

It is worth noting that in the Chinese market, the market share concentration of the top three complete machine manufacturers Goldwind, Envision Energy, and Mingyang Intelligent has declined for the first time since 2017. In 2020, the market share of these three OEMs totaled close to 49%, a decrease of 13 percentage points compared to 2019. Among them, the market share of Goldwind Technology and Mingyang Intelligent fell by 7 percentage points and 6 percentage points respectively. At the same time, the market share of Shanghai Electric, CRRC Wind Power, Sany Heavy Energy and other OEMs have increased to varying degrees.

The analysis believes that this is mainly due to the sharp increase in industry demand in 2020, which has led to the saturation of orders by leading companies and the rapid increase in the new hoisting capacity of other wind power machine manufacturers.

From the perspective of the absolute value of the new hoisting volume, the domestic hoisting volume of the first-name Goldwind Technology in 2020 is 12.33GW, which is more than twice that of the third-place Mingyang Intelligent; the second-place Envision Energy's domestic hoisting scale is 10.07GW, year-on-year An increase of 4.65GW is the largest increase in new hoisting by Chinese wind power manufacturers in 2020, which makes the hoisting capacity close to twice that of Mingyang Intelligent. The gap in lifting capacity between Mingyang Intelligent and the top two has a tendency to widen, and the once three-legged market structure is undergoing subtle changes.

International market gap

In 2020, China's newly installed wind power capacity will reach a record 57.8GW. It is undeniable that the overall rise of Chinese wind power OEMs is inextricably linked to the strong growth of the Chinese wind power market.

China’s wind power market has contributed more than half of the global wind power market’s new installed capacity. After years of development, Chinese OEMs have firmly controlled the largest piece of the local market share. verification.

The local market is the cornerstone, and the international market is the touchstone of the strength of the whole machine business.

For OEMs, the installed capacity can only show one aspect. Whether the market distribution of installed capacity is reasonable is the other side of the coin, because it means whether the profit income is diversified and whether the market risk can be effectively decomposed. The truly leading OEMs should have the ability to obtain orders in different markets around the world.

In the 2020 global market share list, Goldwind Technology and Envision Energy each entered one place over the previous year. Goldwind's global installed capacity of 13.06GW rose to the second place, and Envision Energy rose to the fourth place with 10.35GW.

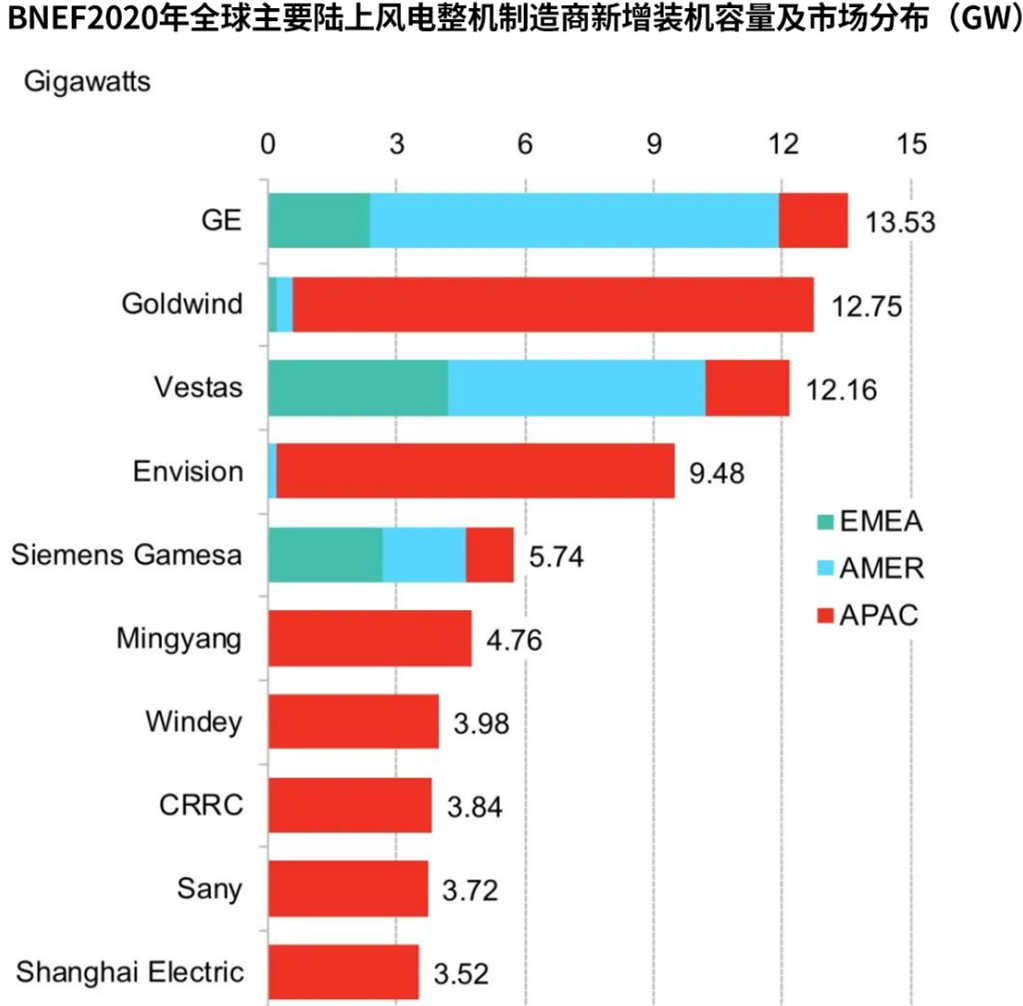

Analysis believes that in the field of onshore wind power, in addition to Goldwind Technology and Envision Energy, the strong rise of most other Chinese complete machine manufacturers mainly depends on their local market. It is also the ability to obtain orders in overseas markets that makes Goldwind Technology and Envision Energy more internationally competitive compared to other Chinese complete machine manufacturers.

Stability is the key

After the rush to install wind power, the new wind power installed capacity in the Chinese market will return to rationality. Under the guidance of the "30·60" dual carbon target, steady growth will become the norm.

During the rush to install, the tide rose, and the whole machine business group was covered with rain and dew. Entering a period of normalized development, the "dark horse" machine vendors that benefit from rush installation will face greater challenges, and their fineness will also be tested.

The tide faded, only to know who was swimming naked.

For the "long-distance running" industry of wind power, stability is the key to success. In the new normal of the era of parity, stability and sustainability will determine the life and death of OEMs, and will also reshape the competition of OEMs. Rapidly iterative technology research and development capabilities, continuous cost reduction capabilities, and diversified full solution capabilities are the keys to the long-term and stable development of complete machine vendors.

Green represents the European, Middle East and African markets, blue represents the American market, and red represents the Asia-Pacific market

Companies like Goldwind Technology and Envision Energy, which have experienced multiple industry peaks and trough cycles, obviously have stronger anti-risk capabilities and have more advantages in the "long-distance race" of the industry. Editor/He Yuting

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~