- China Power Construction will gradually develop its energy consumption structure towards a low-carbon direction

On the evening of April 26, 2021, the first-line "blue chip" China Power Construction (601669, SH) disclosed the 2020 annual report: new contracts signed for the year were 673.260 billion yuan, a year-on-year increase of 31.5%; total operating income was 401.955 billion yuan, a year-on-year increase 15.24%; realized a total profit of 16.207 billion yuan, a year-on-year increase of 18.41%.

China Power Construction has maintained an international leading position in the industry for a long time. It is a business card of China in the field of infrastructure construction. It has all-round advantages of "understanding water and electricity, good at planning and design, long construction and construction, and investment and operation". Power Construction Group, whose core asset is Power Construction, is ranked 157 among Fortune Global 500 companies in 2020, and its international reputation has steadily increased.

Blue chip stocks with outstanding performance in core business

In terms of business contribution, the engineering contracting and survey and design business is the core business of China Power Construction, and it is also the business with the most competitive strength and the largest total revenue. In 2020, this sector will achieve operating income of 332.376 billion yuan, accounting for 83.19% of main business income, and gross profit margin of 11.80%. According to PowerChina, both revenue and gross profit margin have achieved year-on-year growth, mainly due to the rapid expansion of non-traditional business scales such as new energy project contracting, water resources and environmental engineering contracting, and municipal facility engineering contracting. Project profitability has gradually improved, and business structure Further adjust the reasons for achieving good results. Power investment and operation business is the business with the highest gross profit margin among the main businesses of China Power Construction, and it is also an important performance contribution sector. In 2020, the segment will achieve operating income of 18.856 billion yuan, a year-on-year increase of 9.16%, accounting for 4.72% of the main business income, and a gross profit margin of 47.85%, an increase of 3.97 percentage points year-on-year.

Measured from the index of contract orders, POWERCHINA has achieved unexpected growth and laid an excellent foundation for the development after 2020: the total amount of newly signed contracts was 673.26 billion yuan, a year-on-year increase of 31.5%, which is a new contract for the whole year. 121.75% of the total plan. As of the end of the reporting period, the contract stock of China Power Construction was 10.5799 billion yuan, an increase of 11.1% year-on-year. Outstanding performance provides the basis for cash dividends ahead of the market. PowerChina has disclosed the dividend plan in its annual report: It plans to distribute a cash dividend of 0.9264 yuan (tax included) to all shareholders for every 10 shares, and a total cash dividend of approximately 1.403 billion will be distributed. Yuan, accounting for 20% of the net profit attributable to common shareholders of listed companies in the 2020 consolidated financial statements.

Opportunity period for infrastructure upgrade

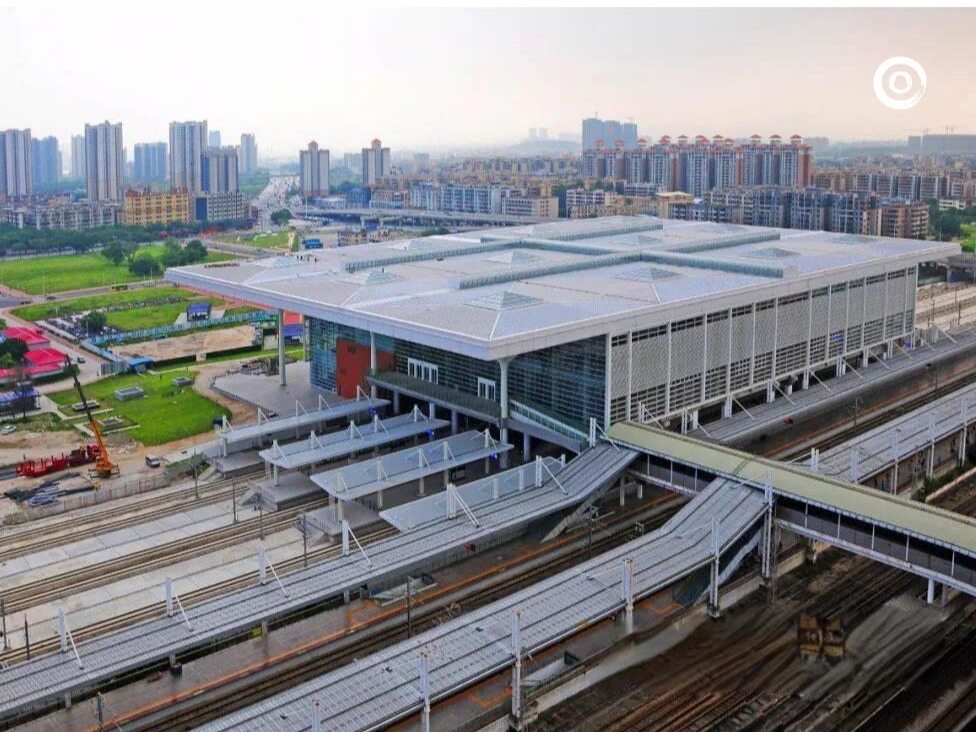

Huge structural growth opportunities are "sprouting" in the field of infrastructure and construction. Leading enterprise China Power Construction is expected by the market. As a globalized development company that advances in the domestic market and the international market, China Power Construction has a great deal of risk diversification. The adjustment advantage of the company also has keen tentacles and rapid deployment capabilities during the period of seizing opportunities. At the macro level, 2021 is the first year of the "14th Five-Year Plan" and is expected to usher in the peak of infrastructure projects. In terms of subsequent business increments, the state is actively expanding its support for infrastructure interconnection. At the same time, the demand for cross-regional interconnection infrastructure is increasing, and key businesses such as rail transit, highways, municipal administration, and housing construction are expected to gain greater There is room for growth, which is more beneficial to companies with compound capabilities and diversified layouts. Continue to optimize the layout of the infrastructure industry, accelerate the cultivation of strategic infrastructure businesses, and form a scientific level of gradient strategic development. "China Power Construction stated in its annual report that it is following up the implementation of key national projects such as the Sichuan-Tibet Railway, accelerating the cultivation and development of strategic infrastructure businesses such as urban complexes, sponge cities, and smart cities, while continuing to strengthen the basic management of international businesses and actively promote The localization of international business will improve the ability to respond to risks in international projects.

Pioneer of Low Carbon Economy

The global energy transition has entered a new stage, and the energy consumption structure is developing in the direction of low-carbon, clean, high-efficiency and popularization. With the continuous breakthroughs in new energy technology, the construction cost of new energy projects has been continuously reduced, and the investment fever has increased. China's green business in recent years It has also developed rapidly since then, and the epidemic has accelerated the development of the low-carbon economy. 2021 is regarded as China's first year of carbon neutrality, and the "low-carbon economy" has become the "outreach." Power China’s three core businesses are energy and power, infrastructure, water resources and the environment. In recent years, it has been committed to upgrading the high-end of the industrial chain and key links in the value chain, and has long-term deployment in the low-carbon economy. Among them, the background color of water resources and environment business is low-carbon economy, and clean energy accounts for 80.42% of energy and power investment business. Power China also stated in its annual report that it is steadily advancing its power investment business with clean energy such as wind power, solar photovoltaic power generation, and hydropower as its core.

Industry insiders believe that the multi-polarization pattern of supply and demand in China's power industry is becoming clearer, the trend of low-carbon structure is becoming more and more obvious, and the intelligent characteristics of the system are becoming more and more prominent. According to the top-level design and planning, wind power and photovoltaic power generation will be represented in the future New energy power generation will enter a period of better and faster development. The water resources and environment business is the key development business of PowerChina. To follow up with the country's opportunities to improve the optimal allocation of water resources and the ability to prevent floods and droughts, PowerChina will strive to promote participation in 150 major water conservancy projects, the protection of the Yangtze River and the Yellow River in 2020. Projects such as high-quality development of the river basin have been implemented, and new water conservancy and water resources and environmental business contracts worth 147.2 billion yuan have been signed throughout the year.

In addition, China Power Construction is also deploying green building materials business. At present, smaller sand and gravel aggregate companies have been shut down one after another, and the industry market is accelerating the shift to green, environmentally friendly, and large-scale. Power China seized the opportunity and won the bid for the aggregate processing project of the Xiong'an Reservoir for the middle route of the South-to-North Water Diversion Project within 2020, and successfully won the mining right of the Dongshan Aggregate Project in Yanshi City, Henan Province, and signed a contract for the comprehensive utilization of resources and green in Luoyang. Demonstration projects of industrial bases promoted the implementation of a number of industrial investment projects such as Changjiu and Changzhi.Editor/Xing Wentao

Comment

Praise

Praise

Collect

Collect

Comment

Comment

Search

Search

Write something~